Beat the blues by focusing on financial wellbeing

- New research reveals those with higher financial wellbeing are much more likely to be content with their lives than those earning top salaries

- Financial wellbeing involves feeling secure and in control, making the most of your money day to day and dealing with the unexpected

- 16 million UK adults1 have lower financial wellbeing, meaning they are more likely to be less satisfied with life

- Beat the January blues to improve financial wellbeing with MoneyHelper’s ‘Couch to Financial Fitness’

On Blue Monday – the gloomiest day of the year – new research from the Money and Pensions Service (MaPS) reveals it’s not what people earn, but their relationship with money that is more likely to help them find happiness.

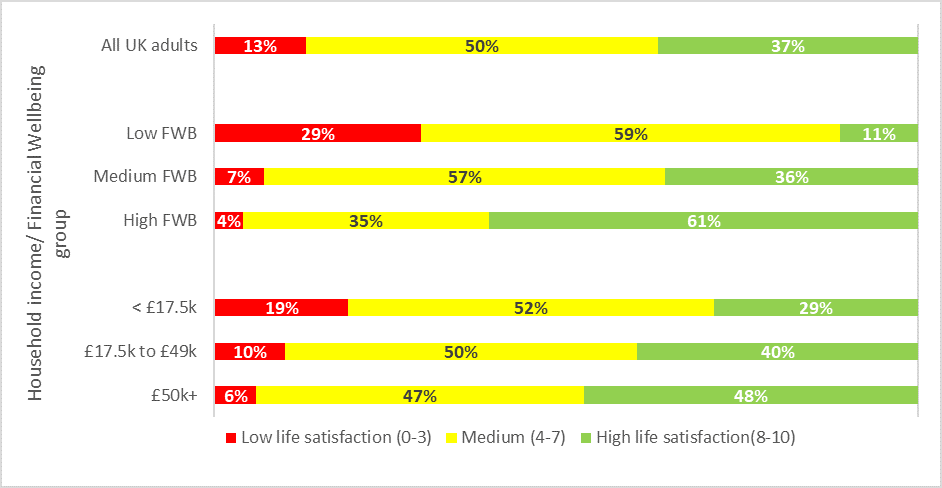

According to the latest MaPS Financial Wellbeing Survey1 of more than 10,000 UK adults, people who have ‘high financial wellbeing’ (feel secure and in control of their money)2 are amongst the most content in society. In fact, people with high financial wellbeing were more satisfied with life than those in households with income over £50,000 per year (61% versus 48%); proof that money alone doesn’t necessarily buy you happiness.3

The survey found that across the UK 16 million adults (31%) have low financial wellbeing, and more than a third (36%) admit to feeling worried when thinking about money matters.1 To help people lead a happier 2022, MaPS is urging people to start the new year with a financial health kick and try ‘Couch to Financial Fitness’ – a free and flexible online programme to improve financial wellbeing week by week – on its MoneyHelper website.

Sarah Porretta, Financial Wellbeing Expert at the Money and Pensions Service, which provides the MoneyHelper service, said:

“Financial wellbeing isn’t just about how much money we have; it’s about feeling secure and in control; making the most of your money day-to-day; being able to deal with the unexpected and being on track for a healthy financial future.

“We want to empower people to take control of their finances and start their journey to financial fitness, health and happiness. ‘Couch to Financial Fitness’, available on the MoneyHelper website, is a great place to start this journey. It coaches people to improve their financial wellbeing week by week, whether they are a complete beginner or getting back on track, in the same way they would their physical or mental health.

“Couch to Financial Fitness’ guides people through three simple activities per week over four weeks, to help them master the money basics, followed by a five-week extension to strengthen financial habits. To find out more visit https://couchtofinancialfitness.moneyhelper.org.uk/.”

Nancy Hey, Executive Director of the What Works Centre for Wellbeing, adds:

“We know that feeling secure and in control of your money, being able to pay the bills and deal with the unexpected is a key driver of workplace wellbeing. Healthy, happy employees can help organisations to perform better, be more creative, and have reduced turnover, sickness and absences.

“It is great to see the Couch to Financial Fitness as one of a range of programmes that are now on offer to support financial wellbeing. It is really important that these are evaluated well, in order to help them to continuously improve, and also fill the gaps in our understanding about what works and contribute to wider learning about the impact of these programmes.”

Professor Sharon Collard, Chair in Personal Finance at the University of Bristol, comments:

“January can be a difficult time of year if you are worried about bills piling up after Christmas. This year many people are facing additional money pressures as they grapple with the ongoing financial impact of the pandemic and rising cost of living.

“Money issues can sometimes feel overwhelming, but research shows that if we are able to build positive behaviours and habits – such as saving regularly (even small sums), staying on top of credit, and taking steps to plan for retirement – this can help us feel more in control and have a higher life satisfaction as a result.”

The MoneyHelper website also offers a number of easy-to-use guides and tools such as Money Navigator to help people deal with the financial impact of the pandemic and avoid financial issues worsening in the future.

For those struggling with indebtedness, MoneyHelper’s money experts offer free, impartial and confidential debt advice over the phone, online and via WhatsApp, and urge people to get in touch right away for support and guidance by calling 0800 138 7777.

-ENDS-

For media enquiries contact:

MaPS Press Office 020 8132 5284 / media@maps.org.uk

Kindred Agency 020 7010 0888 / moneyandpensions@kindredagency.com

Notes to editors

- The Financial Wellbeing Survey is a nationally representative survey of 10,306 adults living in the UK. It consists of online and postal interviews during July to September 2021. The research was conducted for the Money and Pensions Service (MaPS) by Critical Research.

Data is weighted to be representative of the UK 18+ population by region/devolved nation, age, gender, Indices of Multiple Deprivation, housing tenure, urbanity, ethnicity, working status and internet usage. - MaPS has developed a set of nine multiple choice questions to ascertain a person’s financial wellbeing. These are built around the five national goals in the UK Strategy for Financial Wellbeing. MaPS split the UK population into roughly three equal groups of financial wellbeing: low (31%), medium (35%) and high (34%). These splits were calculated by grading all respondents to our financial wellbeing survey scores out of 100, based on criteria within the survey.

- Life satisfaction – in the Financial Wellbeing Survey 2021 we asked: “Overall, how satisfied are you with your life nowadays? Please answer on a scale of 0 to 10, where 0 is ‘not at all satisfied’ and 10 is ‘completely satisfied’”

About MoneyHelper

MoneyHelper is a single destination to make peoples’ money and pensions choices clearer and put them in control. Backed by government, it provides free money and pensions guidance over the phone, online and face-to-face. It was launched this summer by the Money and Pensions Service. MoneyHelper will empower people across the UK to manage their financial wellbeing with greater confidence and clarity throughout their lifetimes by bringing together the services previously provided by the Money Advice Service, The Pensions Advisory Service and Pension Wise.

For more information, please visit www.moneyhelper.org.uk

About Couch to Financial Fitness

Launched in Summer 2021, Couch to Financial Fitness is a new online tool brought to consumers by MoneyHelper. The online programme offers a free and flexible ten-week plan that helps people better understand their finances, so they can come away feeling more resilient, confident, and empowered to manage their money.

Topics users will cover as money essentials include cutting costs, staying on top of bills and strengthening savings, followed by an extra five extra weeks of activities to prepare for life’s money milestones including starting a family, buying a home or saving for retirement.

For further information, please visit: https://couchtofinancialfitness.moneyhelper.org.uk

About the Money and Pensions Service

The Money and Pensions Service (MaPS) is here to ensure every person feels more in control of their finances throughout their lives: from pocket money to pensions. When they are, communities are healthier, businesses are more prosperous, the economy benefits and individuals feel better off. MaPS delivers free and impartial money and pensions guidance to the public through MoneyHelper, which recently brought together legacy services the Money Advice Service, The Pensions Advisory Service and Pension Wise.

MaPS is working to make sure the whole of the UK understands that financial, physical and mental health are all deeply connected. MaPS’ role is to connect organisations with the shared purpose of achieving the five goals set out in the UK Strategy for Financial Wellbeing.

MaPS supports innovation so that everyone can use the most effective methods to help people feel more in control of their money, targeted to those most in need and inclusive of people from all backgrounds. MaPS is an arm’s-length body sponsored by the Department for Work and Pensions (DWP).

For further information visit www.maps.org.uk. Members of the public can get free guidance about their money and pensions via: www.moneyhelper.org.uk / 0800 138 7777.