Mental health and money: how Covid-19 could create the perfect storm

This Mental Health Awareness Week, the chief executives of Mind and the Money and Pensions Service talk about the increasingly familiar link between money and mental health, and how the mental health and financial sectors are working together to respond to people’s changing needs during the coronavirus outbreak and beyond.

Paul Farmer, CEO of Mind

Money and mental health are often linked. Poor mental health can make managing money harder and worrying about money can make mental health worse. People need advice and support for both – and often at the same time.

One in four people in the UK will experience a mental health problem this year, while nearly half of people in problem debt also have a mental health problem. We also know that people with a longstanding mental health problem are more than twice as likely to live in poverty than those without.

The more I worried about money, the more unwell I got.

– Lily, Mind blogger

For some people, poor mental health can make it harder to earn, manage money and spending, and to ask for help with finances. Some people with a mental health problem can find that when they are unwell their ability to process information and problem solve is affected, their energy and motivation is depleted, and they may experience impulsive behaviour or put off paying bills.

People’s experiences are different, but we know that for many, worrying about has an impact on your mental health. For these and many other reasons, we’re concerned that people with mental health problems can experience poorer financial wellbeing.

Integrating mental and financial wellbeing

When the Money and Pensions Service (MaPS) approached me to chair a cross-sector group on mental health as part of the UK Strategy for Financial Wellbeing, I was struck by the timeliness of the initiative, and the potential for collaboration between organisations supporting people’s mental health, financial services and others. Mental health is everyone’s business, but too often the connection between mental health and money hasn’t been recognised. I shared MaPS view that mental health and money matters are often inextricably linked. This work sits alongside our wider work and campaigning to make sure that people with a mental health problem don’t fall through the gaps and have the money they need – whether that’s from work, statutory sick pay or the benefits system.

Since the Challenge Groups launched in February, both mental and financial wellbeing have been brought to the fore by the coronavirus outbreak. For some coronavirus is having an impact on their mental health, for others it is a difficult time financially. Many will be facing a double impact of worse mental health and financial insecurity. This is central to our thinking as we take forward the UK Strategy for Financial Wellbeing.

I’m very pleased we’re looking at mental health across of all MaPS’ goals for the next decade and embedding it in the strategy. Mental health is integrated throughout the discussions on debt, credit and savings, from financial education at a young age through to finances in later life.

Our aim is to improve the financial wellbeing of people with mental health problems in the UK. We are looking forward to publishing recommendations for collaborative action make this happen, both in the shorter term and by 2030.

Working together

We are finally beginning to have more honest and supportive public conversations about mental health, which we hope will lead to more openness and collaboration in how organisations respond. There is still more to do to raise awareness and understanding about how money worries can be compounded by experiences of poor mental health, or vice versa.

We’ve learnt various things about the relationship between mental and financial wellbeing so far.

Credit use and debt advice

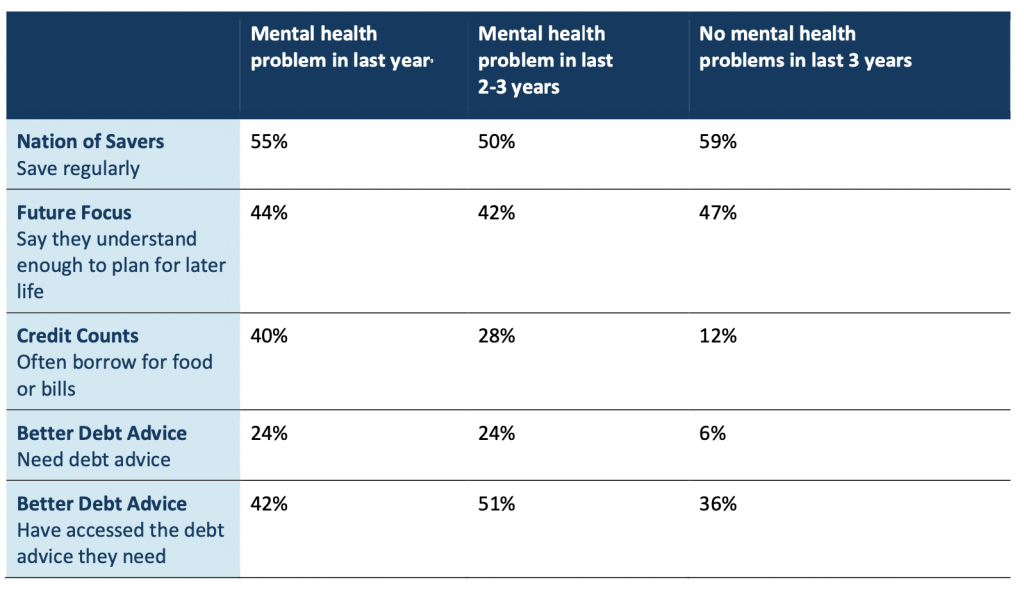

The different financial wellbeing outcomes around credit use and debt advice are particularly striking.

Half of the debt advisers in one survey had spoken to a client whom they seriously believed might go on to end their own life, but 31% of these advisers had never received any training in suicide prevention. We know that people in problem debt are three times more likely to have thought about taking their own life than their peers.

Disclosure and support from financial services

I’m worried that I will be made redundant… I’m struggling financially already. Every aspect of my life is in crisis.

– Respondent to Mind coronavirus survey

The Money and Mental Health Policy Institute, another organisation represented on the Mental Health Challenge Group, found in their December 2019 research that half of all adults (50%) think their bank or building society should use their financial data to identify problems and offer support, with only around one in ten (12%) disagreeing.

Referral and signposting

Mind is pleased to be an agency that MaPS frontline money services refer money guidance customers to.

– Paul Farmer, chief executive of Mind

People experiencing major changes in life, such as relationship breakdown, job loss, an adverse change in mental health seek money guidance in only 41% of life events.

People experiencing major changes in life, such as relationship breakdown, job loss, or experiencing poor mental health seek money guidance in only 41% of life events. And in 2019, only 28% of people using community mental health services reported getting any financial or benefits advice.

Signposting or referring clients with mental health problems to free money guidance and debt advice could be a simple step that companies could take when appropriate.

Referral should be a two-way affair. Mind is pleased to be an agency that MaPS frontline money services refer money guidance customers to.

Training frontline staff to deliver money guidance to people in need of extra support is also an option that’s being explored. MaPS is funding and coordinating trials that should help us understand whether this could prevent issues like problem debt.

The effect of the coronavirus outbreak

Though the links between money worries and mental health issues are not new, coronavirus is making them more clear:

At Mind, we’ve heard from many people who are anxious about the prospect of losing work or coping with reduced pay. And isolation, uncertainty and even less access to support are all having a knock-on effect on how people are managing their mental wellbeing and their money. Of those who have responded to our survey so far, over three quarters (76%) of people whose employment status has changed say that financial concerns have made their mental health worse (compared to 47% of people overall).

The Office for National Statistics (ONS) figures on Covid-19, anxiety and economic wellbeing show that those who feel they are not able to save in the year ahead reported much higher levels of anxiety – 33% higher on average – than those who think they will be able to save money.

In the coming months, it will be no surprise if the levels of anxiety around financial wellbeing increase.

Other research into people’s experiences highlights:

- the pressure of self-isolation on relationships, and the need for support for couples and families, including facilitating conversations about finances

- concerns around access to mental health services and about creditors chasing for money

- how young people’s money worries are particularly acute

- a high incidence of anxiety and depression as a results of coronavirus.

Next steps

I lost my job due to Covid-19 I have no income, I’m in debt because I have no money to pay back a loan… I feel worthless… I don’t even know how I am expected to pay rent, bills, food.

– RESPONDENT TO MIND CORONAVIRUS SURVEY

Together with the Challenge Groups and the team at MaPS, I am discussing with others across different sectors and around the UK what the response to these issues should be.

This is not something that any single organisation or sector can take on alone. But through this work and under the banner of the UK Strategy for Financial Wellbeing, we are determined to make sure that people with mental health problems get both support and respect when it comes to money matters.

Caroline Siarkiewicz, CEO of the Money and Pensions Service

MaPS and Mind working together to improve the UK’s financial wellbeing is more important now than ever before. When MaPS launched the UK Strategy for Financial Wellbeing, we were absolutely clear that that no one organisation could achieve its goals alone. It’s been invaluable to have Paul and the Mental Health Challenge Group’s combined expertise and passion to help shape the strategy. As the sponsor for this particular group, and with my background in debt advice, mental health is an area that’s very close to me.

In recent years, many discussions have taken place to determine how best to define vulnerability, so that services could more easily identify and support at-risk customers, such as those experiencing mental ill health. The recent coronavirus pandemic has highlighted what our research has shown for some time: most of us are just one life event away from financial difficulty. Many of our customers in the UK are experiencing that one life event now, in the form of Covid-19.

We know money matters and mental health are often related and that one can adversely affect the other, and what we understand so far shows that people experiencing mental ill health have worse financial outcomes. It’s not surprising that, with a decreasing but still powerful dual stigma around financial difficulty and mental ill health, there are many barriers for people to overcome in getting help.

Learn more about the UK Strategy for Financial Wellbeing and contact the MaPS partnership team for help to signpost your clients to money guidance and debt advice.